ChatPion

Developed using Facebook official API

Revolutionary, world`s very first, and complete marketing software for Facebook & other social medias developed using official APIs.

Revolutionary, world`s very first, and complete marketing software for Facebook & other social medias developed using official APIs.

Setup messenger bot for replying 24/7 with visual flow builder.

Live chat with Facebook/Instagram subscribers

Template, hide/delete offensive comment, keyword based reply, generic reply to Facebook pages posts comment.

Instant/schedule posting on social medias.

Few steps to connect your Facebook & Instagram account and make this app work.

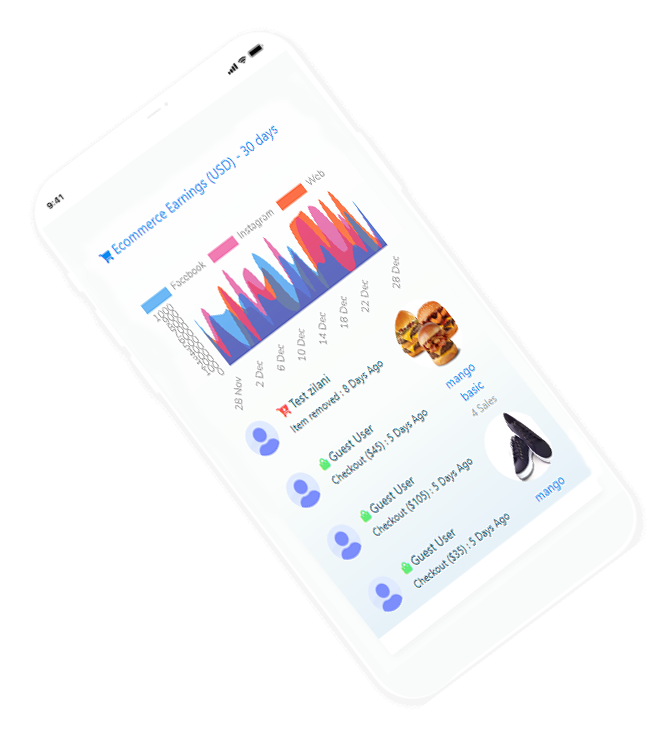

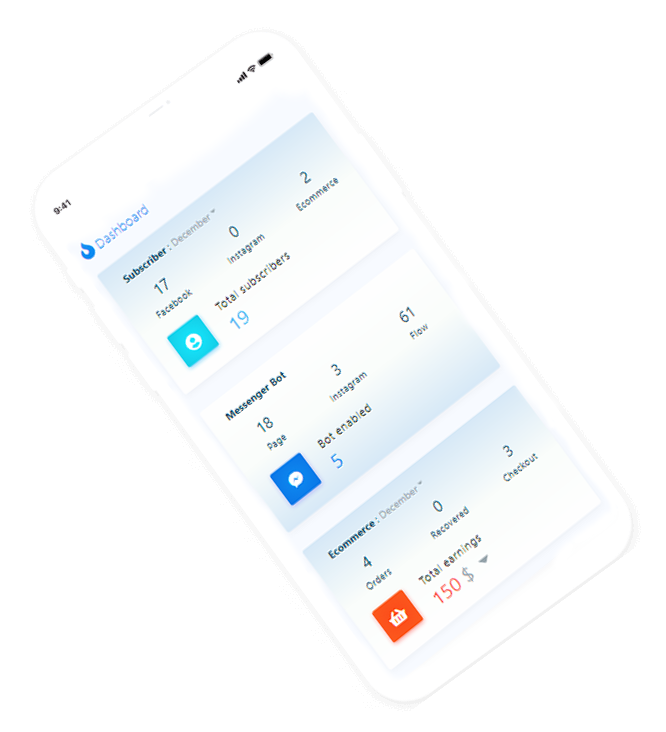

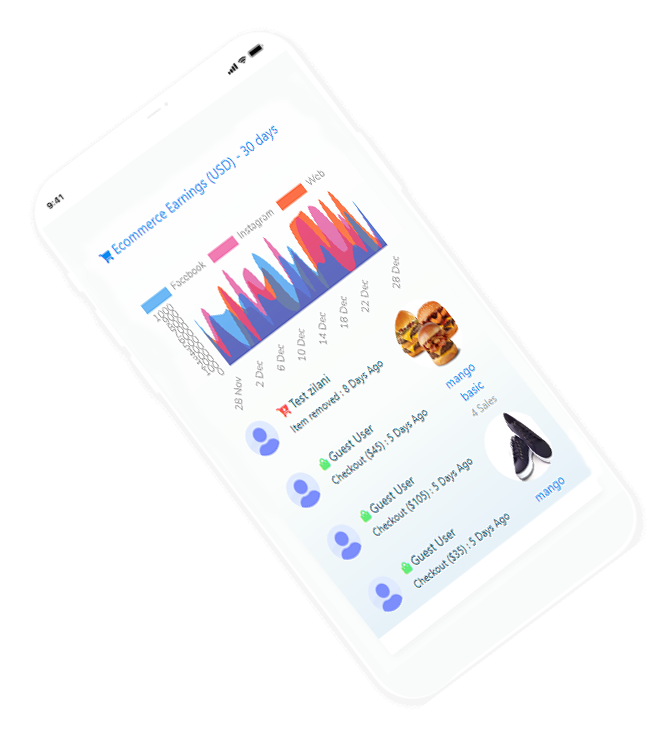

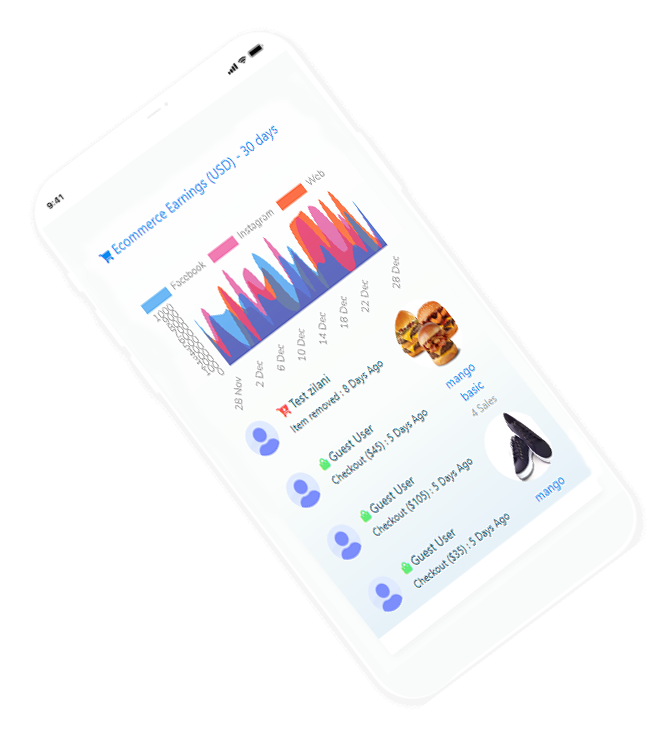

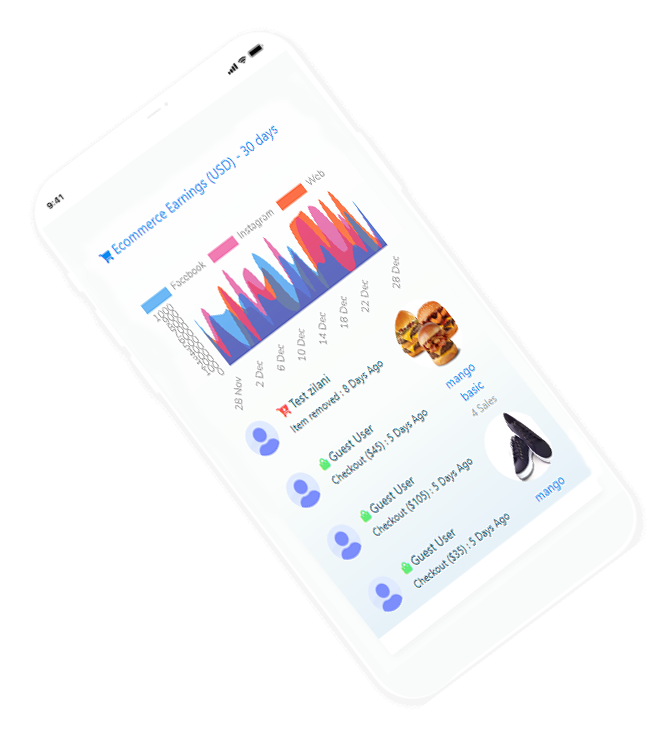

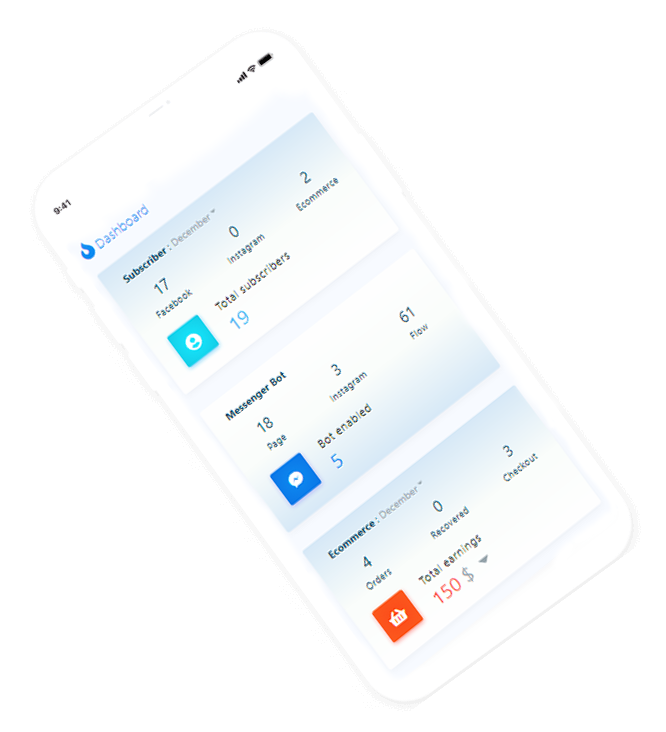

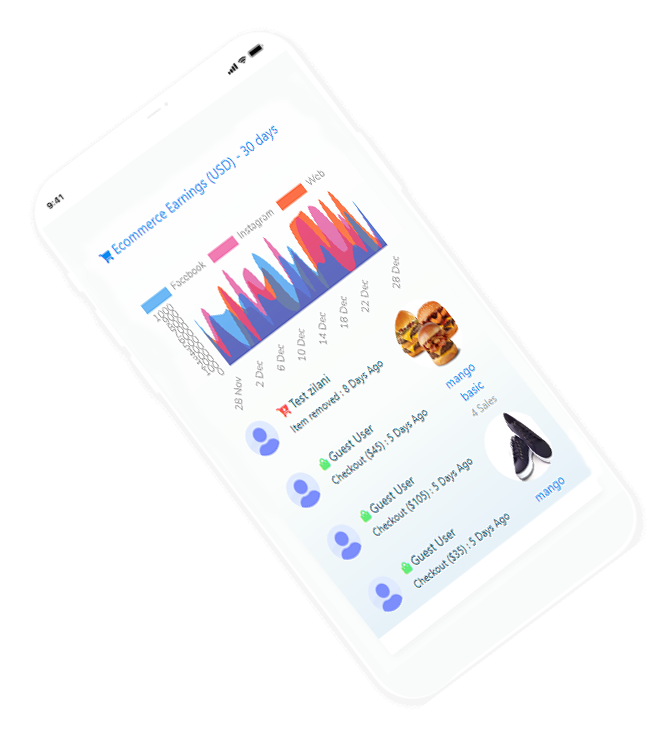

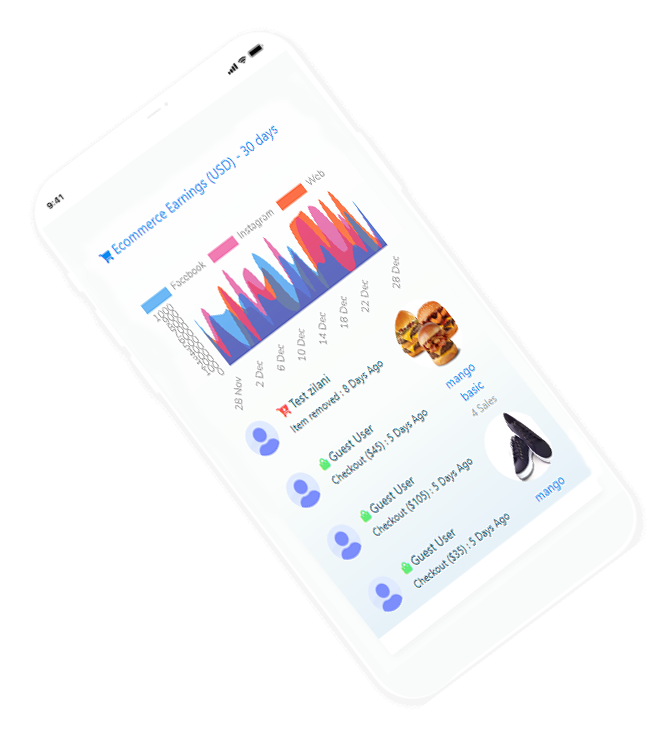

Here are some screenshots of how it looks. see the amazing shots and enjoy.

We provide you trial package, so that you can see awesomeness in action and explore it more.